Shipping Containers For Sale

Shipping Container Shortage In 2023

The last several years have seen shortages in the availability of shipping containers in the United States. The majority of these shipping containers come from China, and so we look to China to understand the reasons for the shipping container shortages.

Some industry professionals pose questions asking if part of the reason is that American consumers don’t want to buy Chinese goods any longer due to rising anti-China sentiments. Others think the cause for the cargo container deficit can be blamed on the economic downturn in the USA and worldwide.

Let’s take a closer look at what global economic, political, and social forces may be responsible for the shortage of used shipping containers in the USA market.

This article will cover the following:

Shipping container shortage – possible causes?

China largest manufacturer of shipping containers

Anti-China sentiments among American consumers

Freight costs

World economy performance and 2023 forecast

Freight and Fuel costs

Forecast for 2023 – Boom?

USA shipping container shortage 2022

Since the early days of the global pandemic in 2020, world cargo supply chains have seen unprecedented disruptions. Overseas manufacturers closed factories in response, and thousands of Conex containers that generally would be filled with manufactured goods stopped being shipped to the USA and remained stuck in port storage facilities.

Consequently, international freight companies reduced the number of ships at sea in reaction to declining demand and the decrease in manufacturing in Asia.

Covid protocols and restrictions have led to port congestion in major US container ports like Long Beach. The slowdowns were experienced in reduced unloading capacity, longer transit times, delays in ships being allowed to offload, and a spike in shipping rates. This was compounded by further delays in logistics management. The shipping logistics sector was forced at times, to reduce operations to minimal levels owing to a lack of skilled labor that could cope with a surge in demand for online orders placed by consumers stuck in lockdown and ordering from large online retailers like Amazon.

This combination of factors has led to severe shipping container shortages in 2021 and 2022.

Source: sourcetoday.com

China manufactures the world’s shipping containers

If we want to get to the bottom of the shipping container shortage, a good place to start is at the source. The People’s Republic of China not only produces much of the world’s consumer goods but also makes the shipping containers in which those goods are shipped. Approximately 85% of the total shipping containers are manufactured in mainland China.

8 out of every ten Conex boxes are fabricated by three large Chinese companies: CIMC, Dong Fang, and CXIC.

China’s Zero Covid causes trade disruption

What do China’s zero-COVID policies mean for global economic trade? China’s strict zero-COVID policies have profoundly affected all areas of the Chinese economy and had a ripple effect that complicates economic recovery in the rest of the world.

In China’s questionable attempt to eliminate all cases of COVID-19, prolonged lockdowns and strict quarantine guidelines have led to labor and manufacturing disruptions (as we saw in the news of the Foxconn factory in Zhengzhou, China, that makes iPhones) and economic slowdowns. Foreign investors are justifiably concerned about the economic position of China.

“It has a huge impact on economic growth when large parts of the country continue to exist under various forms of lockdown,” Dane Chamorro, head of global risks and intelligence at Control Risks, told Yahoo Finance, ” China is absolutely key for global growth.”

Source: Yahoo Finance

An economics professor at Yale University, Stephen Roach, predicts “ongoing impacts” on the Chinese economy and, as a consequence, the world economy.

“The numbers I saw suggest that the current wave of lockdowns is impacting areas that account for about 25% of Chinese GDP, which is higher than last April during the Shanghai-focused lockdowns,” Roach said. “This has consequences for near-term Chinese growth prospects with knock-on effects around the world.”

source: Yahoo Finance

According to Bloomberg economists, China could see a return to regular activity by the middle of 2023, but until then, the social unrest, contraction of market openness, continuing supply chain issues, and the CCP’s Covid management policies will discourage investors.

“We have to watch what is happening in terms of implications on supply chain, implications on geopolitical tensions between the U.S. and China,” says Tarek Robbiati, CEO of HPE, in an interview with Yahoo Finance.

source: Yahoo Finance

Anti-China sentiment among American consumers

Anti-China sentiment by US consumers has been described as being at a ‘historic high’ by the findings of a Pew Research Survey. Political friction over trade agreements, the government’s Zero-Covid policies, the Wuhan lab controversy, and China’s reputation for human rights violations are all negatively influencing China’s largest trading partner’s perceptions.

According to recent polling, more than 70 % of Americans say that they “hold negative views of China”

source: scmp.com

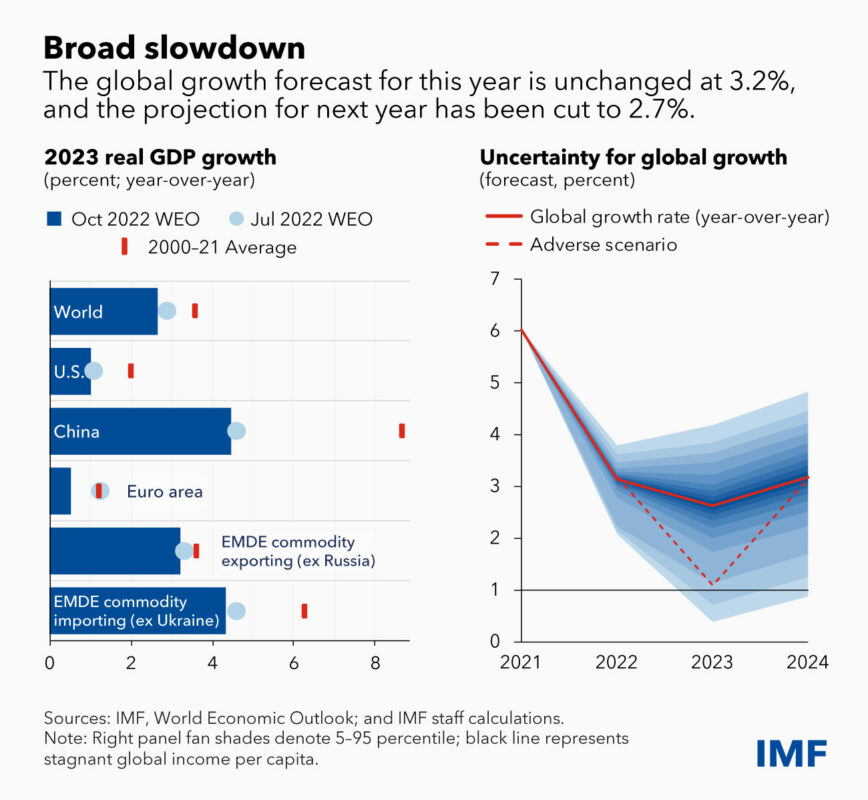

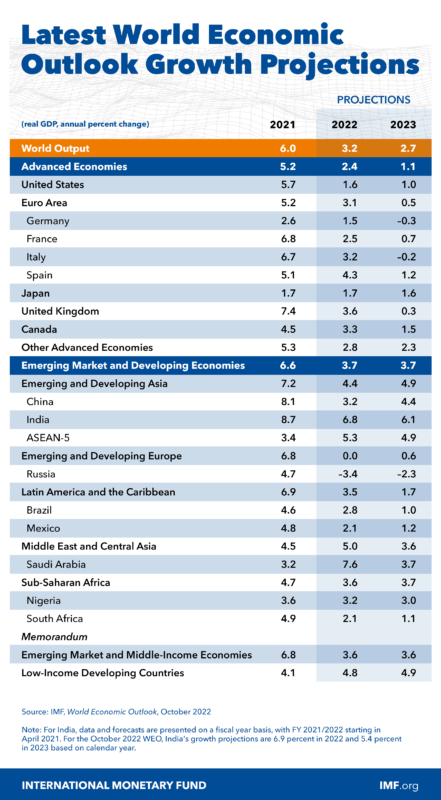

image source: imf.org

image source: imf.org

Is it possible that this perception of China is having a significant effect on imports from China (and the shipping container supply)? A brief Google search will produce multiple results like:

Why we should stop buying from China?

How do I avoid buying Chinese products on Amazon?

Tips for Avoiding Chinese Goods on Amazon

What will happen if we boycott Chinese products?

For example, an article helping American consumers to spot and boycott Chinese products offers the following tips:

Avoid brand names that are weird combinations of consonants and vowels.

Avoid products that are identical to one with different brand names.

Carefully inspect products that have generic product titles and do not list a brand name.

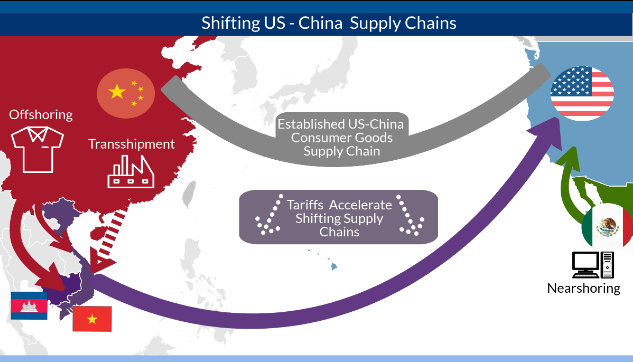

Fewer Chinese Imports in 2022

Trade between the USA and China has fallen precipitously in 2022 from 504,935.4 million in 2021 to 462,575.1 in 2022. This means thousands fewer shipping containers were making their way into USA shipping ports.

image source: .atlanticcouncil.org

image source: .atlanticcouncil.org

U.S. trade in goods with China – Trade statistics by year

TOTAL 2022 124,471.5 462,575.1 -338,103.7

TOTAL 2021 151,442.2 504,935.4 -353,493.2

TOTAL 2020 124,543.8 432,683.4 -308,139.5

TOTAL 2019 106,481.2 449,110.7 -342,629.5

TOTAL 2018 120,281.2 538,514.2 -418,232.9

2022: U.S. trade in goods with China

Src: census.gov

All figures are in millions of U.S. dollars

42 percent of Americans in one survey said they have a “very unfavorable view of China.” This figure has nearly doubled since 2019, when 23 percent answered the same. Is this a significant factor that partially accounts for the plunge in Chinese imports?

High freight costs

The last 2 years have seen fuel costs at near-historic highs. Any car owner has undoubtedly noticed a spike in fuel prices at the gas pump – fuel cost is directly related to the rates for freight transport. This has been reflected in the spike in freight costs worldwide.

The global pandemic’s peak created extreme demand and record freight costs. With shipping prices so high, the increased costs are passed onto the consumer – quickly confirmed by a trip to the supermarket where the costs of basic necessities have all ballooned.

These conditions discourage consumer spending, with fewer numbers of American shoppers opening their wallets and pulling out their credit cards to buy. This decrease in consumer spending, as it applies to shipping containers, means fewer containers are being filled with expensive goods on their way to consumer markets in the United States.

source: intekfreight-logistics.com

Will freight and fuel prices go down in 2023?

According to industry experts, the most likely scenario is for diesel prices to decrease to a degree in 2023. American consumers have already seen some relief from the highs seen earlier in 2022.

Diesel prices (and other gas prices) increased in 2022. At the time of this writing, the US Energy Information Administration has the average price per gallon at $5.33 – an increase of 43% compared to the same time the previous year. The EIA reports the 2022 average price per gallon at $4.97 and projects the 2023 average to be around $4.29.

source: imf.org

Inflation in the World economy

Inflation has climbed to a 40-year high in many economies – including the USA.The resulting slowdown in global economic activity overall is described as “broad-based.” According to economist Pierre-Olivier Gourinchas, up to one-third of the world economy will possibly contract in 2022 and 2023 amid shrinking real incomes and rising consumer prices.

image source: imf.org

Factors contributing to this economic downturn include the Russian invasion of Ukraine, a cost-of-living crisis created by climbing inflation, the economic repercussions of the pandemic, and the previously mentioned economic slowdown in China.

In the world’s three biggest economies, the USA, China, and the European region, growth will continue to be slowed. Some economists fear that the worst is yet to come and, for many economies, 2023 will feel like a recession. International trade is predicted to dip, and if that happens, we will continue to see lower numbers of shipping containers available on the market.

source: imf.org

Shipping container availability in 2023

As with any type of economic forecast, the observers are divided in their predictions about what will happen in the coming year. Some industry sources claim that this shipping container shortage will continue into 2023 According to other industry experts, we can predict more shipping containers to be available heading into 2023. Let’s examine the critical arguments for both sides.

Will the shipping container shortage continue?

In a report issued in November 2022, some experts forecast that the cargo container crisis is likely to extend well into 2023, caused by several factors in the freight shipping industry that have their origin in the Covid pandemic and have subsequently worsened over time:

- Delays in the processing of transport and documentation of the goods

- Economic recession in many of the largest trading partner companies

- Bottlenecks in many of the largest ports around the world are caused by a lack of storage space.

- Higher operating expenses due to increased freight transportation rates.

- The political complications and economic problems in the People’s Republic of China

- The specter of new strains of Covid-19 emerging that could potentially add new health and security protocols, creating further delays in the logistics sector.

An optimistic forecast for shipping container availability in 2023

As most of the world moves on from the restrictions caused by the Covid pandemic, freight transportation times look to return to normal by early 2023. As a result of the resumption of a normal supply chain operation, ports may see the release of 4.3 million TEU of empty Conex containers into North America.

Due to the trade imbalance between China and the USA – far fewer containers carrying US exports are returned to China than the numbers coming in this direction from Asia to the USA. It is not cost-effective to send empty containers back to China; therefore, US ports can accumulate empty shipping containers.

The CEO of Sea-Intelligence, Alan Murphy, explains that these empty containers can not be repatriated to their country of origin, China. “This will potentially overwhelm empty container depots in the U.S., an issue which is already beginning to materialize,” says Murphy.

Shipping experts Sea-Intelligence explain that during the peak periods in shipping volumes, cargo containers can be held up in longer supply chains.To illustrate what happens, we look at one aspect of the supply chain. The time it requires is from when the cargo is ready at the exporter until the importer takes delivery. Before the pandemic, transportation time was an average of 45 days. Thai time expanded significantly during the pandemic, peaking at a transit time of 112 days in the first quarter of 2022. This time has declined to 88 days in length as of the end of August 2022 – according to supply chain analysis figures by Sea-Intelligence.

To offset the shortage caused by supply chain delays, freight companies asked manufacturers to build an increased number of new shipping containers. The new containers that were manufactured in Asia were fed into the existing supply chains.

“As transportation time is now getting shorter, these additional containers will be released back out of the supply chain, and they will start to pile up, primarily in Europe and the U.S.,” forecasts Murphy.

Source: freightwaves.com

Shipping costs are expected to continue to fall from the peak we saw in 2022. For example, one freight shipping company has gone from quoting 10,000 USD in 2021, down in price to cost about 5,000 USD at the time of this writing. Ocean freight rates overall continue to decrease due to global inflation and the world moving on from Covid-19.

This is good news for American customers who want to buy a used shipping container for home or business use.

Quick Quote

Quick Quote