Shipping Containers For Sale

Global Shipping Container Shortage

Global Shipping Container Shortage

At the time of this blog post, there is a shortage of shipping containers worldwide, which has contributed to prices rising and availability falling.

Measures to stop the spread of Covid-19 all over the world have caused massive disruptions in normal international trade, creating delays and causing to freight (largely comprised of container shipping from Asia) rates to rise. A significant part of these delays in supply chain are due to the shortage of shipping containers in major sea ports.

According to ConexDepot CEO Luke Ward “New and used shipping container prices are affected by several factors including the cost of raw materials and freight prices, but mostly a high demand driven by a lack of availability pushed prices to record high levels starting in the last quarter of 2020, but continuing into Q1 of 2021.

From May 2020 to Nov 2020 we saw the following increases in new shipping containers costs at a wholesale level:

20FT New Conex: 24% increase

40FT New Conex: 21% increase

20FT Used Conex: 96% increase

40FT Used Conex: 56% increase”

In this article we will delve into what are the causes affecting shipping container supply and demand and what does the future hold?

The problem in a nutshell

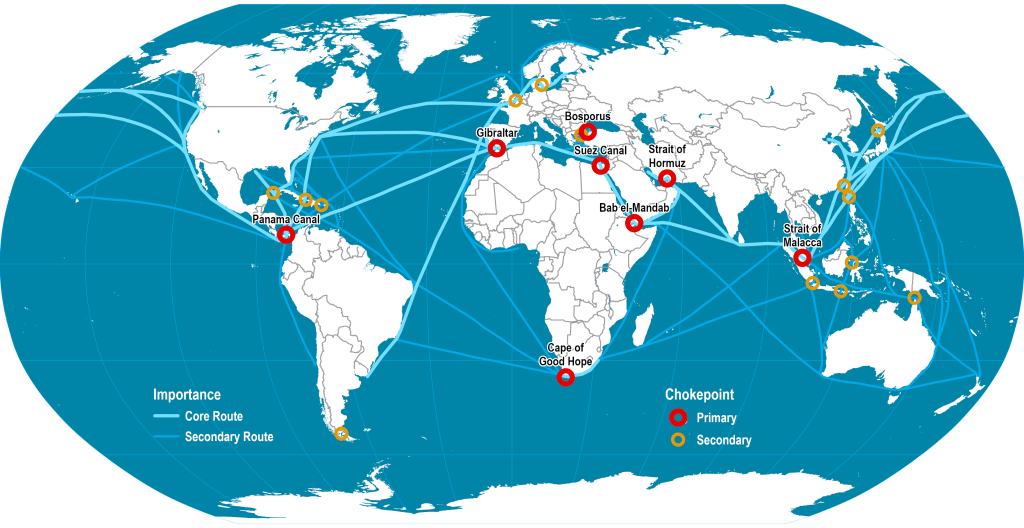

International container shipping rates have soared (and are expected to continue to rise) based on a combination of severe Conex container shortages and increased demand on transpacific trade lanes.

The curious thing is that before the pandemic, there was a vast surplus of empty shipping containers in North America. Quite simply, there were more loaded cargo containers being imported into the USA than there were being refilled with export goods and shipped back towards their ports of origin in Asia. The majority of the shipping containers that we see are manufactured in China and shipped out of major sea ports in Asia.

Since the trade volumes are not balanced between USA and China – for example – not as many containers are being returned to China. The simple economics of the matter are that it costs freight shippers more to ship an empty container back to China than it does to manufacture a brand new container at China’s end. Historically, this meant vast yards of used, empty sea containers stored in yards adjacent to major USA coastal ports.

Intermodal container freight shipping is the most efficient and economical way of shipping goods and commodities to the marketplace. However, these previously low-cost ocean shipping routes are now experiencing large freight rate increases and delays.

What is a “Black Swan” event?

Recently, a spokesperson for Hapag-Lloyd (a global leader in container shipping) described the current global container shortage as a “black swan” event.

“We are currently seeing a ‘black swan’ and are experiencing the strongest increase in 40’ demand following one of the strongest decreases in demand ever. Both happening within just 6 months. Almost 3 out of 4 containers in our 40-foot fleet are currently deployed in Customer Shipments and is therefore not available for the time being. The containers must be returned to China as quickly as possible to be equipped for an expected strong fourth quarter”, says Nico Hecker of Hapag-Lloyd.

Definition: A “black swan” is an unpredictable event that is beyond what is normally expected of a situation and has potentially severe consequences. Black swan events are characterized by their extreme rarity, severe impact, and the widespread insistence they were obvious in hindsight.

Source: Wikipedia

The expression was made popular by author Nassim Nicholas Taleb, a finance professor, and former Wall Street trader in his 2007 book “The Black Swan: The Impact of the Highly Improbable”.

The book was published before the 2008 global financial crisis and author Taleb explained that because black swan events are impossible to predict due to their inherently low probability, if and when they do occur, the consequences can be catastrophic.

The COVID-19 pandemic is a Black Swan event

The demand for 40 foot Conex boxes in the second quarter of 2020 was low and shipping companies were looking for strategic and cheap storage places for the unused, surplus containers. After several months of the pandemic, the demand for containers has spiked significantly.

“It’s hard to believe that in early July 600,000 TEU of 40’ containers were “empty on ground” The situation has reversed completely. “The 350,000 TEU sitting on ground are hardly covering 2 weeks of global export volumes” explain Nico Hecker and Christian Halgmann from Hapag-Lloyd´s Container Steering department.

This is all following “…one of the strongest decreases in demand ever” six months previous to the pandemic.

How has the pandemic affected shipping container supply and demand?

The simple situation is that a large number of “blank sailings” caused by the corona outbreak have resulted in the containers becoming stranded in China.

A blank sailing is a sailing that has been canceled by the carrier, which may mean one port is skipped, or the entire string is canceled, causing a shortage in the US and many other countries.

Ship cargo unloading delays in China, quarantines on incoming ships from countries (including the U.S. for 14 days), and delays on the return trips of ships from China. In the USA, E-commerce merchants are also suffering the effects of the peak season delays, for example sellers using Amazon Fulfillment.

All of these factors left shippers waiting for thousands of empty containers to continue to ship their cargo. It is an indicator of the severity of the shortage that damaged and otherwise unusable containers have been dropped off at warehouse – a sign that shippers have reached the bottom of their supply.

This undersupply of empty Conex containers exerts a huge pressure on the global supply chain, due to the shortage as many containers exported to China are not being returned. The difficulties for USA importers became twofold: The first is finding an empty container to fill and the second is booking one of few available spaces on a ship to transport the container. Consequently, the increased demand combined with a backlog of containers worsened by blank sailings and shipping vessel delays has caused an increase in freight rates.

Post pandemic spike in shipping

Following the early, worst months of the pandemic lockdowns, shipping demand experienced a spike.

US imports of consumer products from China rose sharply since late June, as the economy began to reopen from initial COVID-19 lockdowns. US importers encountered problems at Asian ports as there are simply not enough containers to fill the sailings.

The increased volumes of Chinese goods imported into the U.S. since July has overwhelmed U.S. ports, creating congestion and resulted in delays to the return of empty containers to Asia.

The fourth quarter of the year is typically a low season for container shipping, but volumes are higher as major retailers in the US are importing in order to replenish dwindling inventories ahead of the Christmas holidays and the Chinese New Year shortly thereafter.

The cancellation of international flights during the pandemic, resulted in a decease in air freight – which typically consists of high-value, time-sensitive cargo such as PPE, medical equipment and supplies and e-commerce purchase fulfillment.

Shippers who depend on fast shipping times have shifted from air freight to premium ocean shipping due to the large numbers of passenger flight cancellations from Asia to USA during the pandemic.

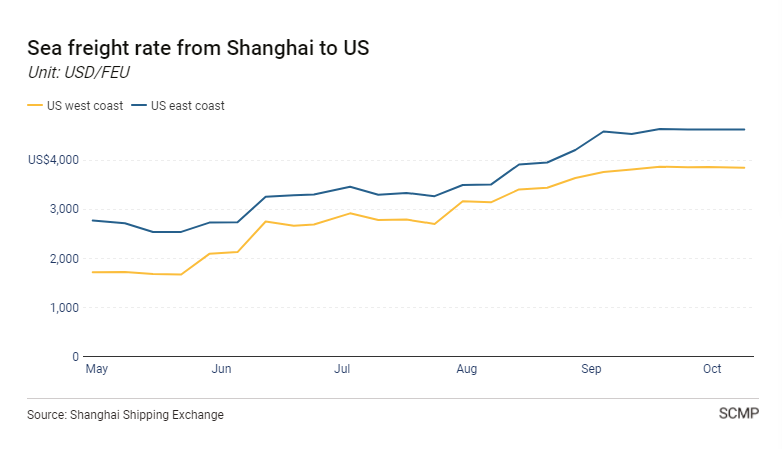

Increase in Container Shipping rates

According to a report on theloadstar.com, “Intra-Asia rates have increased due to the lack of equipment and space caused by blank sailings,” said Peter Sundara, VP at LF Logistics. We saw a sharp increase in rates in the USA in the period of 30 September and 1 October, the rates increased by 37.2% with a jump from $1,496 to $2,052 per *TEU.

The freight rate from the major port of Shanghai to the West coast of the USA increased more than 80 per cent since June to US $3,848 (per 40-foot container) in October. In the East coast ports, the rates rose nearly 70 per cent to US $4,622, according to the Shanghai Shipping Exchange.

* a TEU is the twenty-foot equivalent unit (often TEU or TEU) is a unit of cargo capacity often used to measure the capacity of container ships. For example, large container ships are able to hold more than 18,000 TEU. To calculate the TEU of a container, divide the length of the container (in feet) by 20, which is then used to calculate the cost of shipping for the container.

Importers in Latin America reported they have seen freight rates from Asia double. Comparable rate hikes have been experienced by South American ports receiving shipments on the Pacific Ocean. Shipping rates are expected to continue rising as some shippers cancel North American sailings to prioritize capacity and equipment in the Asia region.

Trade Imbalance and the US – China Trade War

The Trump Administration has renegotiated a number of policies to correct the long existing trade imbalance between 2 of the world’s largest economies.

China’s trade gap with United States increased by 43% (as of September 2020) than when President Trump took office.

China’s exports to the US – lead by large volumes of electrical goods and medical equipment – increased by 20.36% to $43.96 billion. Trade analysts suggested the gap would have been even higher if Beijing not been trying to meet the terms of the Phase One Accord on the new trade agreements.

Behind this surplus in trade are imports of low-end manufactured goods like masks and PPE (personal protective equipment) used to combat the virus. Additionally, the demand for housewares and electronics – products made in China – skyrocketed during a global work-from-home boom.

The result of this import/export imbalance is that not as many empty containers were being returned to China (to be refilled) as were returned West filled with cargo. The consequence is that the demand for new containers is exceeding the production capacity in China by a significant margin, resulting in manufacturing schedules for new containers until into next year.

How Are Container Shipping Companies Dealing With the Shortage?

The main challenge for shipping companies is to return empty containers from the US to Asia.

According to sea trade-maritime.com the shipping companies are prioritizing to get empty containers shifted back to China as fast as possible – “even to the degree where they are willing to forego viable export cargo, as that would serve to slow down the repatriation of empty containers.”

This current state of equipment shortage is leading to more scrutiny at each step from trade regulators on multiple fronts of the shipping supply chain. Shipping trade authorities the FMC have reportedly received complaints that shipping carriers are purposely avoiding shipping exports to the U.S., to take advantage of quicker return times of empty containers to China.

Among the measures by shipping authorities to expedite the return of empty shipping containers and mitigate the container shortage include:

– reducing free storage time at port warehouses in the US

– denying export bookings to quickly turn the containers and get the empties back to Asia

– repositioning empty containers to Asia from other trade routes

– a financial penalty payable to the owner of a ship in event of a failure to load or discharge the ship according to the scheduled time

– relief on detention and demurrage charges in the US’s two largest ports – imposed by carriers as an incentive to expedite the turnaround of empty containers

– implementing yield management and prioritizing containers for high-yield cargo

The shipping companies have even gone so far as shipping empty containers and open space on our ships to Asia.

“30,000 TEU of empty containers are lifted towards Asia week-by-week” quotes an industry spokesperson.

Chinese Conex container manufacturers at peak capacity

According to scmp.com, w world wide container shortage brings an unprecedented demand for the Chinese companies who manufacture new shipping containers. Order volumes for new shipping containers have been limited by manufacturing capacity in China – the world’s largest producer of containers. All available empty containers are booked and the Chinese manufacturers are running at maximum capacity.

According to the China Machinery Industry Federation figures, container production in China has increased by +61% from the previous year to 7.8 million square meters (84 million sq ft). Manufacturing times for new containers are approximately three weeks – which are typically leased for 15 years before being sold used for other purposes.

What does the future hold?

shipping trade analysts are optimistic that the container shortages will be corrected back closer to historic levels as the world gradually returns to normal after the global pandemic. In the short term, the shipping world copes with container shortages and price fluctuations due to the market forces of supply and demand.

Quick Quote

Quick Quote